Bajaj Housing Finance Share Price Target from 2024 to 2030: A Detailed Projection

Bajaj Housing Finance Limited (BHFL), a leading subsidiary of Bajaj Finance Limited, has positioned itself as a prominent player in India’s housing finance sector. With its diverse offerings, robust financial performance, and innovative strategies, BHFL has become a trusted name for both retail and institutional investors. The company’s successful IPO in 2024 has further solidified its market position, attracting widespread investor interest.

In this blog, we will explore the Bajaj Housing Finance share price target from 2024 to 2030, delving into its financial performance, market strategies, and factors driving its growth in the housing finance market.

Table of Contents

Overview of Bajaj Housing Finance

Founded in 2015, Bajaj Housing Finance Limited operates as a non-deposit-taking housing finance company, registered under the National Housing Bank (NHB). The company specializes in offering a wide range of financial products tailored to meet the needs of individual homebuyers, businesses, and developers.

By leveraging cutting-edge technology and forging strategic partnerships, BHFL has achieved a strong foothold in the housing finance industry. Bajaj Housing Finance offers products like retail housing loans, loans against property, and lease rental discounting, making it one of the most comprehensive players in the sector.

Bajaj Housing Finance Share Price Target from 2024 to 2030

Bajaj Housing Finance Share Price Target for 2024

As of November 2024, Bajaj Housing Finance Share Price Target for the year is expected to be ₹200. This projection is based on the company’s consistent financial performance, successful IPO, and its ability to cater to the growing housing demand in India. The IPO raised significant capital, and investors are bullish about the long-term potential of BHFL.

Bajaj Housing Finance Price Target for 2025 to 2030

Looking ahead, the Bajaj Housing Finance Share Price Target for 2025 is projected to increase to ₹290, driven by the company’s expanding market reach, innovative financial products, and strategic plans for growth. The 2025 Bajaj Housing Finance target will be supported by strong financial metrics, with the company continuing its steady growth.

By 2026, BHFL is expected to reach ₹340, followed by ₹445 in 2027, ₹560 in 2028, ₹620 in 2029, and ₹750 by 2030.

| Year | Projected Price (₹) |

|---|---|

| 2024 | ₹200 |

| 2025 | ₹290 |

| 2026 | ₹340 |

| 2027 | ₹445 |

| 2028 | ₹560 |

| 2029 | ₹620 |

| 2030 | ₹750 |

These projections underscore the Bajaj Housing Finance‘s resilience, consistent growth trajectory, and its ability to adapt to market dynamics.

Key Highlights of Bajaj Housing Finance:

- Type: Non-Banking Financial Company (NBFC-UL)

- Parent Company: Bajaj Finance Limited

- Focus Areas:

- Retail housing loans

- Loans against property (LAP)

- Developer financing

- Lease rental discounting

Bajaj Housing Finance IPO Details

In September 2024, Bajaj Housing Finance launched its much-anticipated IPO, which turned out to be one of the most successful public offerings of the year. The overwhelming subscription rates reflected strong investor confidence in the company’s growth prospects.

Key IPO Facts:

- Issue Price: ₹66-₹70 per share

- Lot Size: 214 shares

- Issue Size: ₹6,560 crore

- Subscription Rates:

- Qualified Institutional Buyers (QIB): 209.36x

- Non-Institutional Investors (NII): 41.37x

- Retail Investors: 6.81x

The Bajaj Housing Finance IPO raised ₹6,560 crore, bolstering its capital base and providing funds to scale its operations, strengthen technological infrastructure, and explore new markets.

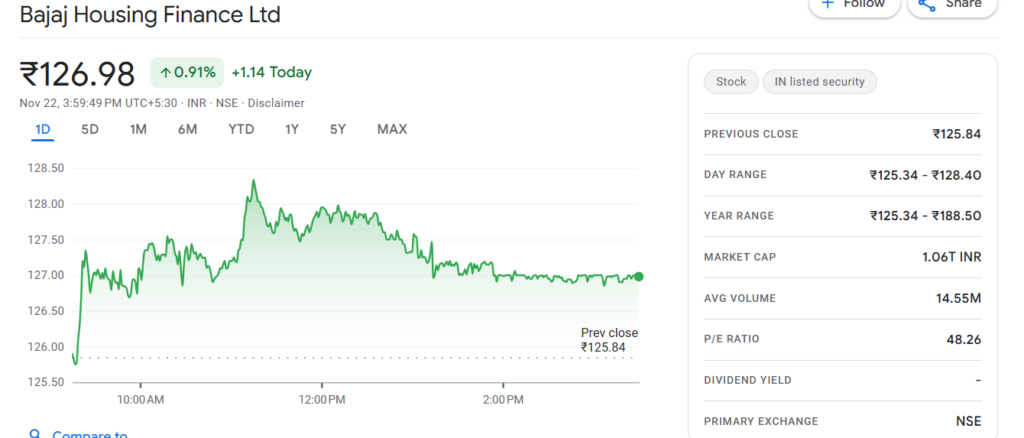

Bajaj Housing Finance Share Price Performance Overview

Since its IPO, Bajaj Housing Finance’s share price has shown remarkable performance, driven by its solid fundamentals and positive market sentiment. Below is a snapshot of its current share price metrics as of November 2024:

- Open: ₹134.39

- High: ₹134.99

- Low: ₹133.15

- Market Cap: ₹1.12 Lakh Crore

- P/E Ratio: 51.11

- 52-Week High: ₹188.50

- 52-Week Low: ₹128.26

This performance reflects the company’s potential for long-term growth, making it a favorite among investors.

Factors Driving Growth from 2024 to 2030

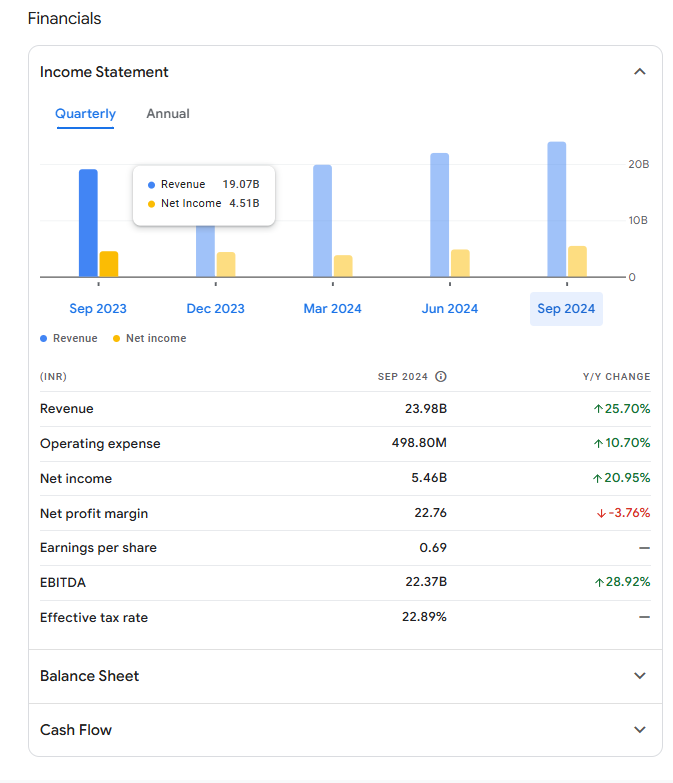

1. Strong Financial Performance

Bajaj Housing Finance has demonstrated consistent growth in revenue, profits, and total assets over the years. Its ability to maintain financial stability while expanding operations is a testament to its strong governance and operational efficiency.

- Revenue (FY24): ₹7,617 crore

- Profit After Tax (FY24): ₹1,731 crore

- Total Assets (FY24): ₹81,827 crore

This robust financial performance positions BHFL as a key player in the housing finance industry, driving investor confidence.

2. Expanding Market Reach

Bajaj Housing Finance operates across 215 branches in 174 locations in India, tapping into urban and semi-urban markets. Its strategic focus on underserved areas has enabled the company to increase loan disbursements and build a loyal customer base.

This expansion supports the Bajaj Housing Finance Share Price Target for the coming years, as it taps into growing housing demands in India.

3. Technological Advancements

The company’s adoption of digital platforms and AI-driven processes has enhanced its operational efficiency and customer experience. Features like instant loan approvals and real-time tracking have made BHFL a market leader in the housing finance sector. With technological innovation at its core, Bajaj Housing Finance is well-positioned to maintain its competitive edge in the market.

4. Regulatory Compliance

Being classified as an Upper Layer NBFC by the RBI reflects BHFL’s adherence to stringent regulatory standards, ensuring transparency and stability. This status enhances its credibility among investors and customers alike.

5. Rising Housing Demand

With India’s rapid urbanization, the demand for housing loans is expected to surge. BHFL is well-positioned to capitalize on this trend, offering tailored solutions for first-time homebuyers and developers. This growing demand directly contributes to the Bajaj Housing Finance share price target projections for 2024-2030.

Frequently Asked Questions: About Bajaj Housing Finance Share Price Target from 2024 to 2030

Q1: Is Bajaj Housing Finance a good investment?

Yes, with its strong financial performance, expanding market presence, and technological advancements, BHFL offers significant long-term growth potential.

Q2: What factors will influence its share price by 2030?

Key factors include housing demand, regulatory changes, financial performance, and technological innovation.

Q3: What was the IPO subscription rate?

The IPO witnessed a stellar subscription rate of 209.36x for QIBs, 41.37x for NIIs, and 6.81x for retail investors.

Q4: What is the projected share price target for 2025?

The share price target for 2025 is ₹290, driven by the company’s consistent growth and market expansion strategies.

Conclusion

Bajaj Housing Finance Limited stands out as a promising investment opportunity for long-term investors. With its strong fundamentals, innovative strategies, and expanding market presence, the company is well-positioned to capitalize on India’s growing housing finance market.

The projected share price targets from 2024 to 2030 highlight its consistent growth potential, making it an attractive choice for investors. However, as with any investment, it’s crucial to conduct thorough research and consult with financial advisors before making decisions.

Stay tuned to Mutualsip.com for more insights into stock performance and market trends!