Andhra Petrochemical Share Price Target From 2024 to 2030 : Deep Overview

Explore the projected share price targets for Andhra Petrochemical Share Price Target from 2024 to 2030. This detailed analysis covers the company’s financial performance, market trends, growth drivers, and risks, providing investors with a comprehensive outlook. Learn about the stock’s valuation, price movements, and factors influencing its future performance. Perfect for long-term investors looking for insights into the petrochemical sector’s potential.

Table of Contents

Comprehensive Insights and Future Outlook

Andhra Petrochemical Share Price Target: Andhra Petrochemicals has established a robust presence in the Indian petrochemical industry, and investors are keen to understand the future trajectory of its stock. This detailed analysis will project the potential share price for Andhra Petrochemicals from 2024 to 2030, while considering its market position, growth strategies, and challenges.

Company Overview: A Legacy in Petrochemicals

Andhra Petrochemicals Limited (APL) has been a major player in the manufacturing of oxo-alcohols and other petrochemical derivatives. With a diverse portfolio, the company caters to multiple sectors, including automotive, pharmaceuticals, and textiles. Over the years, APL has shown resilience, adapting to market demands and industry changes.

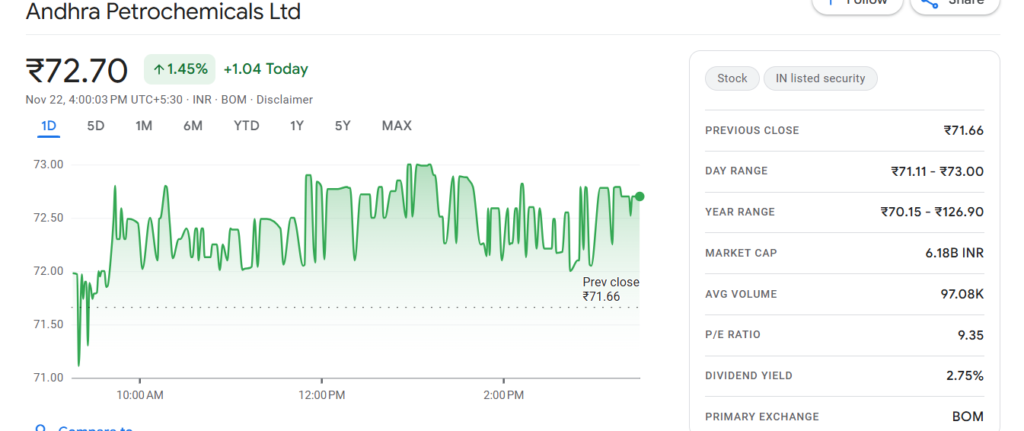

Andhra Petrochemical Share Price Target: Current Market Performance:

Here’s a snapshot of Andhra Petrochemicals’ stock performance:

| Metric | Value |

|---|---|

| Current Price | ₹72.70 |

| Market Capitalization | ₹618 Crore |

| P/E Ratio | 9.35 |

| 52-Week High | ₹126.90 |

| 52-Week Low | ₹70.15 |

| Dividend Yield | 2.75% |

Despite a 12-month dip of approximately 8.69%, the stock appears undervalued, making it an attractive investment for value-seeking investors. The dividend yield of 2.75% adds to its appeal for long-term investors.

Andhra Petrochemical Share Price Target From 2024 – 2030

Andhra Petrochemical Share Price Target From 2024-2025: The following table shows the projected share price targets for Andhra Petrochemicals from 2024 to 2030:

| Year | Projected Share Price (₹) |

|---|---|

| 2024 | ₹132 |

| 2025 | ₹195 |

| 2026 | ₹255 |

| 2027 | ₹325 |

| 2028 | ₹395 |

| 2029 | ₹368 |

| 2030 | ₹428 |

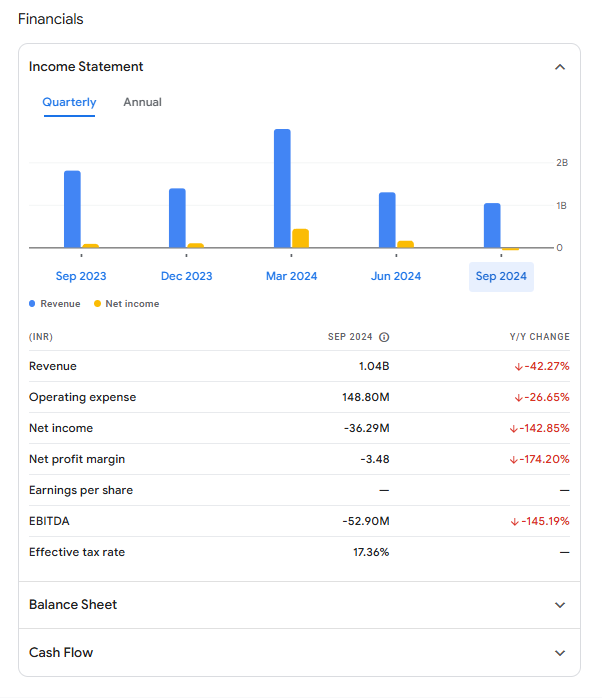

Andhra Petrochemical Share Price Target: Key Growth Drivers:

- Strong Demand for Petrochemical Products

The growing industrialization in India, particularly in sectors like packaging, construction, and automotive, increases the demand for petrochemicals. This provides a solid base for Andhra Petrochemicals’ growth prospects. - Technological Advancements

Andhra Petrochemicals continues to invest in new technologies for production efficiency. These technological upgrades will reduce costs and improve product quality, boosting profitability and competitiveness. - Government Support

India’s government policies promoting manufacturing and sustainability will benefit Andhra Petrochemicals. Incentives such as tax breaks and support for clean energy will help the company expand its operations. - Global Expansion

The growing global demand for petrochemical products, particularly in emerging markets, positions Andhra Petrochemicals for further expansion. Its focus on increasing exports will help diversify its revenue streams.

Andhra Petrochemical Share Price Target: Challenges to Consider:

While the outlook is positive, investors should be mindful of the following risks:

- Crude Oil Price Fluctuations

As a petrochemical producer, Andhra Petrochemicals is sensitive to fluctuations in global crude oil prices. A rise in oil prices could inflate production costs, affecting profitability (Andhra Petrochemical Share Price Target). - Environmental Regulations

Increased global focus on environmental sustainability and stricter regulations in India may necessitate expensive upgrades to the company’s infrastructure. These could impact profit margins in the short term. - Intense Competition

The petrochemical industry is highly competitive, with both domestic and international players vying for market share. Andhra Petrochemicals must continuously innovate to maintain its competitive edge. - Geopolitical Risks

Trade tensions and political instability in key markets could affect global supply chains and demand for petrochemical products, potentially slowing down growth for Andhra Petrochemicals.

Price Chart : Andhra Petrochemical Share Price Target

Andhra Petrochemical Share Price Target: Investment Outlook:

For investors, Andhra Petrochemicals represents an attractive long-term opportunity due to its undervalued stock price and future growth potential. Here’s why:

- Undervalued Stock

The company’s low P/E ratio (9.35) suggests that the stock may be undervalued relative to its earnings potential. Early investors could benefit from capital appreciation as the stock price catches up to its true value. - Steady Dividend Returns

With a healthy dividend yield of 2.75%, Andhra Petrochemicals appeals to those seeking steady passive income. - Positive Long-Term Outlook

The projected share price targets from 2024 to 2030 reflect strong growth in the company’s future. Assuming continued demand for petrochemical products and effective execution of growth strategies, Andhra Petrochemicals could see significant capital gains.

What factors affect Andhra Petrochemicals’ share price?

Andhra Petrochemicals’ share price is influenced by factors such as global crude oil prices, demand for petrochemical products, competition, and government regulations.

Will Andhra Petrochemicals’ share price reach ₹100 by 2024?

Given the current market conditions and growth expectations, the share price could see significant gains, potentially reaching ₹100, but it will depend on the execution of growth strategies and market stability.

Is Andhra Petrochemicals a good stock to buy in 2024?

Yes, if you are looking for an undervalued stock with solid growth prospects. However, always conduct thorough research or consult a financial advisor before making investment decisions.

What is the potential upside for Andhra Petrochemicals stock by 2030?

Analysts predict a strong upside for Andhra Petrochemicals, with potential price targets reaching ₹428 by 2030, assuming consistent growth and strategic market positioning.

Does Andhra Petrochemicals pay dividends?

Yes, Andhra Petrochemicals offers a dividend yield of 2.75%, which is appealing to long-term investors seeking steady income.

What are the major competitors of Andhra Petrochemicals?

Major competitors include other Indian petrochemical companies like Reliance Industries, Haldia Petrochemicals, and GSFC, all of which operate in similar segments.

How has Andhra Petrochemicals performed historically?

Historically, Andhra Petrochemicals has shown steady growth, although the stock has experienced fluctuations due to global commodity price changes and market conditions.

What is the P/E ratio of Andhra Petrochemicals?

The P/E ratio of Andhra Petrochemicals stands at 9.35, indicating that the stock may be undervalued relative to its earnings potential.

How does crude oil price volatility affect Andhra Petrochemicals?

Volatility in crude oil prices directly impacts Andhra Petrochemicals, as raw material costs are influenced by oil prices,

Can Andhra Petrochemicals maintain growth in a saturated market?

Yes, with innovation and expansion into international markets, Andhra Petrochemicals can continue to grow despite competition in the saturated petrochemical sector.

What are the risks associated with investing in Andhra Petrochemicals?

Risks include global oil price fluctuations, environmental regulations, geopolitical instability, and competition from other petrochemical producers.

What is the 52-week high and low for Andhra Petrochemicals stock?

The 52-week high is ₹126.90, and the 52-week low is ₹70.15, showing some price volatility in the past year.

What should investors expect in the short term (2024)?

In the short term, Andhra Petrochemicals could see moderate price fluctuations, but with strong fundamentals, it is expected to perform well in the medium to long term.

Conclusion:

Andhra Petrochemicals’ future prospects are strong, driven by increasing demand, technological advancements, and favorable government policies. While risks like fluctuating oil prices and environmental regulations should be monitored, the company’s long-term growth potential is substantial. For investors looking for an undervalued stock with strong future upside, Andhra Petrochemicals is a promising option.

Also Read-

IEX Share Price Target 2030: Updated Projections & Key Insights

Vedanta Share Price Target 2030: Expert Predictions & Analysis