Discover Cropster Agro share price target from 2024 to 2030 with in-depth analysis of growth drivers, risks, and financial metrics. Learn how sustainable agriculture and technological innovation are shaping the company’s future. Read now for investment insights!

Cropster Agro has become a hot topic among investors due to its remarkable performance over the past year. With its focus on sustainable agricultural practices and cutting-edge technology, the company has shown immense potential for long-term growth. In this blog, we will provide a detailed analysis of Cropster Agro Share Price Target from 2024 to 2030, exploring growth drivers, risks, and financial metrics to help investors make informed decisions.

Table of Contents

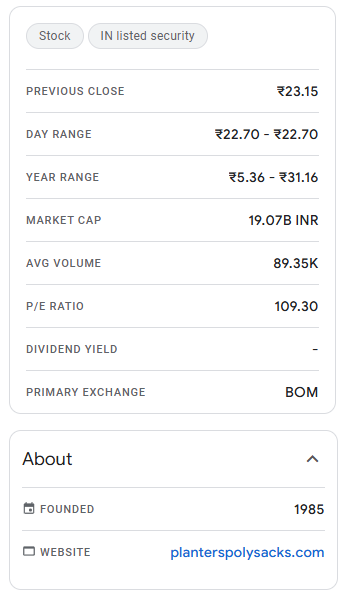

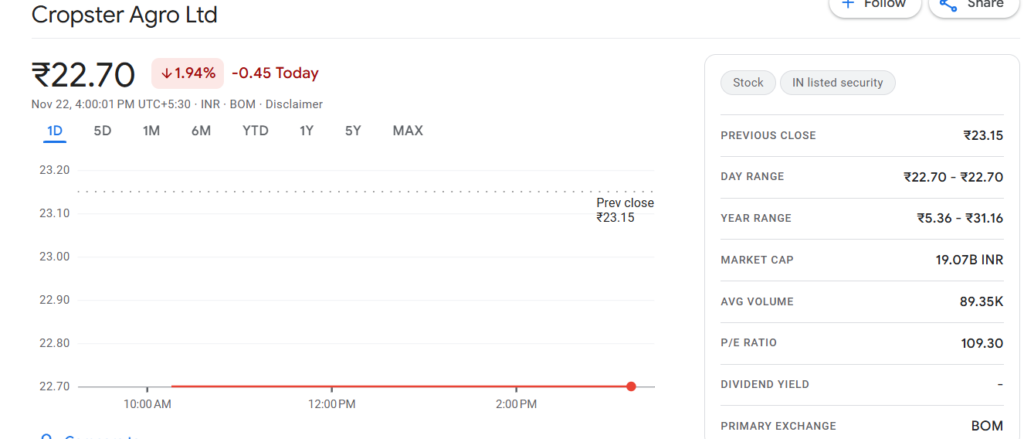

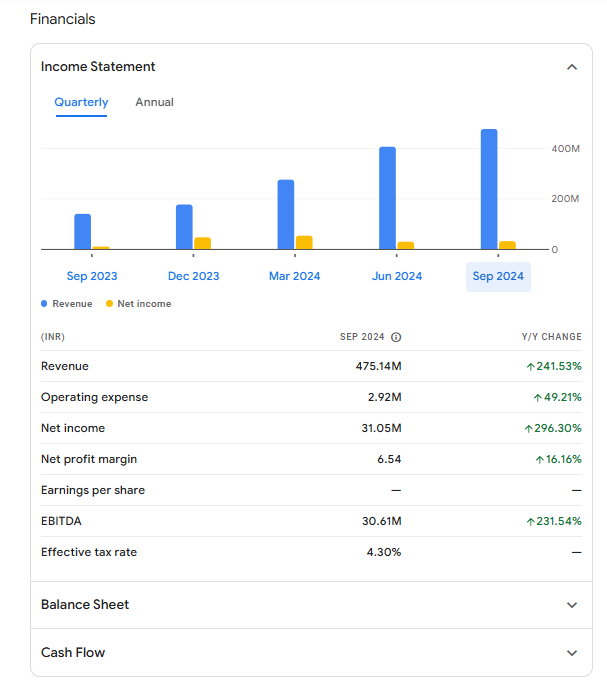

Key Financial Metrics of Cropster Agro

| Metric | Value |

|---|---|

| Current Price | ₹23.15 |

| 52-Week High | ₹31.16 |

| 52-Week Low | ₹5.36 |

| Market Cap | ₹1.94K Cr |

| P/E Ratio | 111.47 |

| Dividend Yield | Not Applicable |

The company’s high P/E ratio reflects investor optimism, though its absence of dividends indicates that most investors are betting on capital appreciation. With 100% retail shareholding, Cropster Agro is currently a favorite among individual investors.

Cropster Agro Share Price Target from 2024 to 2030

| Year | Share Price Target |

|---|---|

| 2024 | ₹32 |

| 2025 | ₹50 |

| 2026 | ₹70 |

| 2027 | ₹90 |

| 2028 | ₹115 |

| 2029 | ₹130 |

| 2030 | ₹150 |

2024: Share Price Target – ₹32

The company is expected to end 2024 with a share price of ₹32, reflecting steady growth driven by increased investor confidence, rising demand for agricultural innovations, and improved operational efficiencies.

2025: Share Price Target – ₹50

By 2025, Cropster Agro is projected to achieve a share price of ₹50. This growth will likely be fueled by the company’s expansion into new markets, strategic partnerships, and its focus on sustainable agriculture solutions. (Cropster Agro Share Price Target from 2024 to 2030)

2026: Share Price Target – ₹70

A target of ₹70 in 2026 reflects the impact of technology adoption, such as precision farming and automation. The company’s collaborations with government projects and focus on improving margins will contribute to this upward trend.

2027: Share Price Target – ₹90

Cropster Agro is expected to reach ₹90 in 2027, driven by its strong domestic and international market presence. Improved scalability, cost control, and operational excellence will boost its valuation.

2028: Share Price Target – ₹115

Crossing the ₹100 mark in 2028 will be a significant milestone. By this time, Cropster Agro’s innovations in sustainable agriculture and market-responsive strategies are likely to pay off, driving its share price to ₹115. Cropster Agro Share Price Target from 2024 to 2030

2029: Share Price Target – ₹130

With a stabilized growth rate, the company is projected to achieve ₹130 in 2029. It is expected to diversify its product portfolio and focus on value-added agricultural solutions to sustain investor interest.

2030: Share Price Target – ₹150

By 2030, Cropster Agro is anticipated to hit ₹150, thanks to years of strategic investments, technological leadership, and a robust market footprint. The company is likely to be a key player in the agricultural sector by this time.

Growth Drivers for Cropster Agro

- Sustainable Agriculture Trends

As the demand for eco-friendly farming solutions rises, Cropster Agro’s innovative products and services are perfectly aligned with market needs. - Technological Advancements

Leveraging technologies like precision farming and automation ensures Cropster Agro stays ahead of competitors in productivity and efficiency. - Government Support

Subsidies, incentives, and agricultural policies favoring sustainable practices create a fertile ground for the company’s growth. - Market Diversification

Entry into new domestic and international markets enhances Cropster Agro’s revenue potential and reduces reliance on single geographies. - Strong Retail Investor Backing

With 100% retail ownership, Cropster Agro enjoys strong investor loyalty, which supports its stock price during volatile periods. Cropster Agro Share Price Target from 2024 to 2030

Risks Associated with Cropster Agro

- Overvaluation

The high P/E ratio of 111.47 suggests overvaluation, which could lead to corrections if earnings fail to meet expectations. - Market Volatility

The agricultural sector is vulnerable to factors like weather conditions, commodity price fluctuations, and government policies. - High Competition

To maintain its edge, Cropster Agro must consistently innovate and improve its offerings in a highly competitive market. - Dependence on Retail Investors

With no institutional investment, the stock price may face volatility due to changes in retail sentiment.

FAQs About Cropster Agro Share Price

1. Is Cropster Agro a good long-term investment?

Yes, Cropster Agro shows strong growth potential due to its innovative approach, market expansion, and alignment with sustainable agriculture trends. However, thorough risk assessment is recommended.

2. What is the expected share price of Cropster Agro in 2025?

The company’s share price is expected to reach ₹50 by 2025.

3. Why has Cropster Agro’s share price risen significantly in the past year?

The stock has grown by over 300% in the past year due to increasing investor confidence, better financial performance, and strategic alignment with market demands.

4. What are the key risks of investing in Cropster Agro?

Key risks include high valuation, market volatility, intense competition, and reliance on retail investors for stability.

5. What factors will drive Cropster Agro’s growth in the future?

Sustainable agriculture trends, technology adoption, government support, market diversification, and investor backing will drive future growth.

Conclusion

Cropster Agro represents a compelling investment opportunity for long-term investors seeking exposure to the agricultural sector. Its focus on sustainability, technological innovation, and market expansion sets it apart from competitors. While the growth potential is immense, investors should carefully consider associated risks and align their strategies with their financial goals.

With its projected share price targets from ₹32 in 2024 to ₹150 by 2030, Cropster Agro promises a rewarding journey for those who believe in its vision. However, prudent research and regular portfolio review are essential for navigating the dynamic nature of the stock market.

Also Read

Unitech Share Price Target 2025: What Experts Predict for Unitech’s Future Growth

Orient Green Power Share Price Target 2030: Detailed Forecast and Analysis