Heritage Foods Share Price Target 2024 to 2030: Predictions for Growth and Market Trends

Explore the projected Heritage Foods share price target 2024 to 2030. Discover growth trends, market analysis, and financial forecasts for the coming years.

Table of Contents

Heritage Foods Share Price Target 2024 to 2030: Predictions for 2024 to 2030

Get the projected Heritage Foods share price target for 2024-2030. Explore growth trends, market analysis, and financial forecasts for the coming years.

As one of India’s leading dairy companies, Heritage Foods Ltd. continues to be a favorite among investors. In this article, we will explore the Heritage Foods share price target from 2024 to 2030, analyzing market trends, company performance, and potential growth factors.

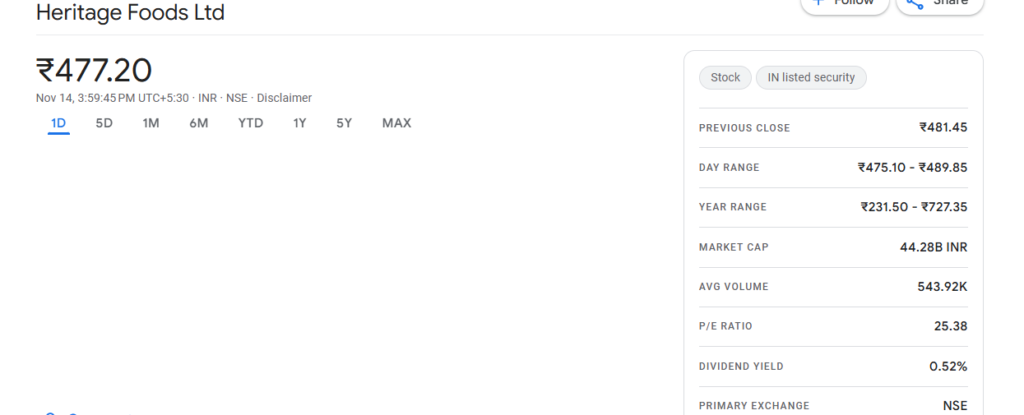

Heritage Foods Share Price Target 2024 to 2030-Market Overview (October 2024)

Open Price: ₹572.00

High Price: ₹579.75

Low Price: ₹565.10

Previous Close: ₹594.80

Volume: 720,447

Value (Lacs): ₹4,071.25

VWAP: ₹566.84

UC Limit: ₹624.50

LC Limit: ₹565.10

P/E Ratio: 35.36

Dividend Yield: 0.44%

52-week High: ₹727.35

52-week Low: ₹209.30

Market Cap: ₹5.24KCr

Face Value: ₹5

This overview highlights the current position of Heritage Foods in the market, providing insight into its financial health and performance as of October 2024.

Heritage Foods Share Price Target for 2024 to 2030

Below are the projected Heritage Foods share price targets for the next several years, taking into account market analysis, historical growth trends, and industry dynamics. Heritage Foods Share Price Target 2024 to 2030

| Year | Share Price Target (₹) |

| 2024 | ₹630 |

| 2025 | ₹845 |

| 2026 | ₹1060 |

| 2027 | ₹1257 |

| 2028 | ₹1475 |

| 2029 | ₹1648 |

| 2030 | ₹1862 |

These projections are based on various factors, including increased demand for dairy products, successful product innovation, and the company’s ability to expand its market share.

Heritage Foods Share Price Target 2024 – What to Expect

In 2024, Heritage Foods’ share price target is expected to reach ₹630, driven by a combination of factors that could boost its performance:

- Rising Demand for Dairy Products:

As consumers increasingly prioritize health and wellness, demand for dairy products such as organic milk and plant-based alternatives is on the rise. Heritage Foods stands to benefit from this shift, with its diverse product line aimed at the growing demand for high-quality, nutritious dairy.

- Expansion in Rural Markets

Heritage Foods has a strong presence in urban markets but expanding its reach to rural India could significantly increase sales. Improved distribution channels and more local partnerships could fuel this growth, driving profitability and impacting the stock price positively.

- Input Cost Management

Fluctuations in milk prices and the cost of other dairy inputs could affect Heritage Foods’ profit margins. Efficient cost management and strategic pricing will play a crucial role in protecting the company’s margins and keeping the share price stable.

Heritage Foods Share Price Target 2025 – Growth Prospects

The 2025 target for Heritage Foods is projected at ₹845. Several factors could contribute to this expected growth:

Product Innovation

Heritage Foods is likely to diversify its product offerings further. With an increased focus on health-conscious dairy products and possible forays into plant-based alternatives, Heritage Foods is well-positioned to capitalize on the changing preferences of Indian consumers.

Strategic Partnerships

Collaborations with e-commerce platforms and partnerships with local dairy farmers can enhance distribution and supply chain efficiency. This could make Heritage Foods’ products more accessible, boosting sales and share price growth in 2025.

Regulatory Compliance

Adapting to evolving regulations in food safety and dairy production will be vital. Heritage Foods’ ability to navigate regulatory changes and maintain high standards will ensure steady growth and could positively impact its share price.

Heritage Foods Share Price Target for 2030 – Long-Term Outlook

By 2030, Heritage Foods’ share price could reach ₹1862. However, there are potential risks that could challenge this growth:

Competition from Local and International Brands

The dairy industry is highly competitive, with numerous players vying for market share. To stay ahead, Heritage Foods will need to maintain product differentiation and enhance brand loyalty.

Raw Material Price Volatility

The prices of milk and other key inputs are highly volatile. If these costs rise sharply, Heritage Foods may find it difficult to pass on the increases to consumers without affecting demand.

Shifting Consumer Preferences

As more consumers adopt plant-based diets and demand organic products, Heritage Foods will need to adapt its product range to meet these new trends, ensuring that it doesn’t lose market share to more agile competitors.

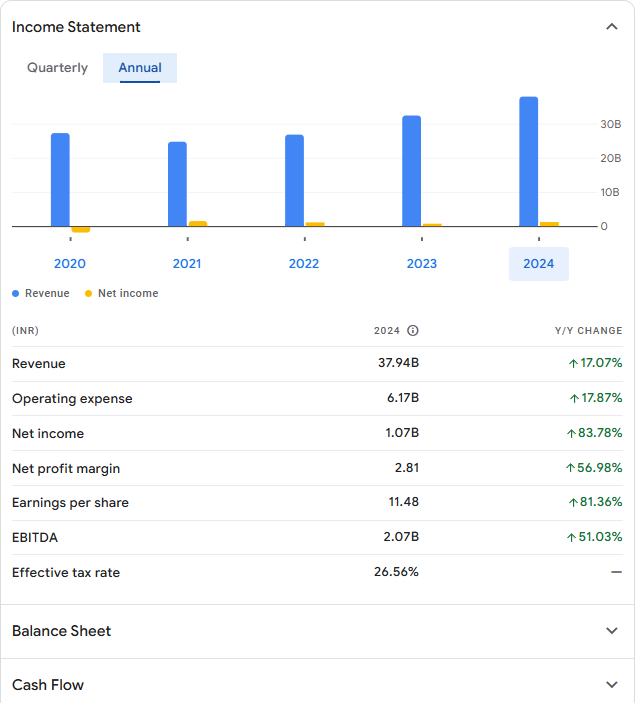

Financial Overview of Heritage Foods Ltd

Here is a snapshot of Heritage Foods Ltd’s financial performance:

| Financials | 2024 (INR) | Year-on-Year Change |

| Revenue | ₹37.94B | +17.07% |

| Operating Expense | ₹6.17B | +17.87% |

| Net Income | ₹1.07B | +83.78% |

| Net Profit Margin | 2.81% | +56.98% |

| Earnings Per Share | ₹11.48 | +81.36% |

| EBITDA | ₹2.07B | +51.03% |

| Effective Tax Rate | 26.56% | — |

This data shows the robust financial health of Heritage Foods, with impressive growth across key metrics such as net income, earnings per share, and EBITDA.

FAQs about Heritage Foods Share Price

Q1: What is the current share price of Heritage Foods?

As of October 2024, the share price of Heritage Foods is ₹565.10.

Q2: What is the share price target for Heritage Foods in 2025?

The expected target for Heritage Foods’ share price in 2025 is ₹845.

Q3: Why is Heritage Foods considered a good investment?

Heritage Foods is a strong player in the dairy industry, with a growing market presence, diverse product offerings, and a track record of financial growth.