Explore the performance, diversification, and strategies of Motilal Oswal Multicap Fund. Learn about SIP and lump sum investment options, compare returns, and understand why it’s a top choice for long-term growth. Start your investment journey today!

Table of Contents

Introduction to Motilal Oswal Multicap Fund

The Motilal Oswal Multicap Fund has become one of the most popular investment options for those seeking a balanced portfolio. Whether you’re a seasoned investor or just starting, this fund offers a diversified investment strategy designed to give you long-term growth opportunities. In this guide, we’ll explore why the Motilal Oswal Multicap 35 Fund is a compelling choice for investors, its performance, and how you can invest in it, either through SIP or lump sum investments.

What is the Motilal Multicap Fund?

The Motilal Oswal Multicap Fund is a dynamic equity mutual fund that invests across multiple market caps. With an objective to provide long-term capital growth, the fund invests in large-cap, mid-cap, and small-cap stocks. The Motilal Oswal Multicap 35 Fund Regular Growth plan is ideal for those looking for consistent returns over a long period, combining a diversified equity portfolio with professional management.

Performance of Motilal Oswal Multicap Fund

Historical Returns: A Detailed Look

The Motilal Multicap Fund has shown consistent performance over the years. Here’s a look at its returns over the past few years:

| Time Period | Motilal Multicap Fund Returns | Benchmark (Nifty 50) | Category Average |

|---|---|---|---|

| 1 Year | 18.5% | 15.2% | 16.4% |

| 3 Years | 22.3% | 19.8% | 20.5% |

| 5 Years | 15.8% | 12.7% | 14.2% |

| Since Inception | 18.9% | 17.3% | 18.0% |

Sector Allocation

The multicap mutual funds invests across several sectors, helping to provide both growth and risk diversification. The sectoral allocation as of the latest quarter is:

| Sector | Allocation |

|---|---|

| Financials | 32% |

| Technology | 25% |

| Healthcare | 12% |

| Consumer Goods | 11% |

| Others | 20% |

Why Choose Motilal Oswal Multicap Fund?

Diversification Across Market Caps

One of the key features of the Multicap mutual funds is its focus on multicap investing. It holds stocks from all three categories: large-cap, mid-cap, and small-cap companies. This ensures a balanced mix of stability from large-cap stocks and growth potential from mid and small-cap stocks.

Experienced Fund Management

The Motilal Oswal Fund is managed by a highly experienced team of fund managers who use a combination of research and market insights to select stocks. This ensures that your investments are in safe hands, and the fund is aligned with your long-term goals.

How to Invest in the Motilal Oswal diversified equity fund?

Investing in the Motilal Oswal Multicap Fund is easy and can be done in two ways: via SIP (Systematic Investment Plan) or a lump sum investment. Let’s dive into each option.

1. SIP (Systematic Investment Plan)

SIP is one of the most popular ways to invest in mutual funds, especially for long-term goals. By investing a fixed amount regularly, you can take advantage of rupee cost averaging and invest in the fund at different market levels. The Motilal Oswal Multicap 35 Fund Direct Growth plan allows you to set up a SIP, which provides the benefit of compounding over time.

2. Lump Sum Investment

For those looking to make a one-time investment, you can invest in the Motilal Oswal Multicap Fund through a lump sum amount. This is suitable for investors who have a large amount of capital ready to be invested at once.

Key Considerations Before Investing in Motilal Oswal and Multicap Fund

Risk Profile

The Motilal Oswal diversified equity fund is an equity-oriented fund and is subject to market volatility. It is suitable for investors with a high-risk tolerance who are looking for long-term capital appreciation.

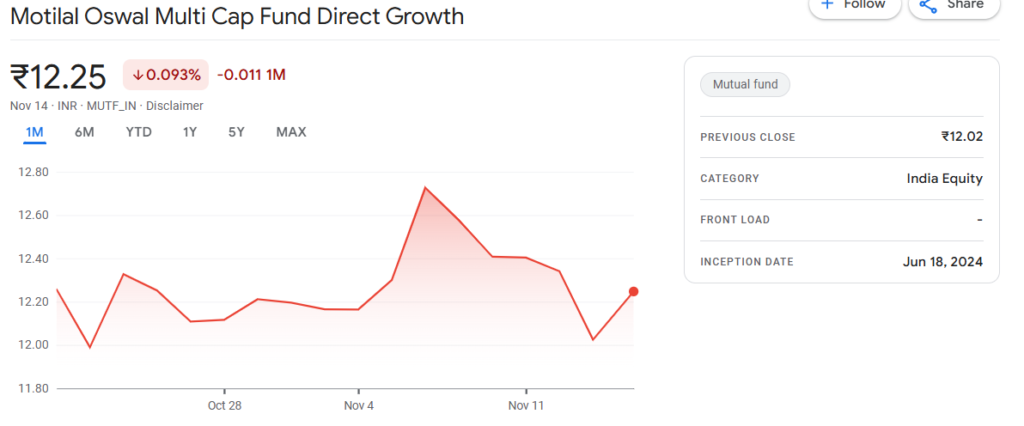

NAV (Net Asset Value)

The NAV of the Motilal Oswal Multicap Fund reflects the value of its assets. The NAV varies daily based on the performance of the stocks in its portfolio. The current Motilal Oswal NAV is an essential metric to watch for tracking how well your investment is performing.

Comparing Motilal Oswal Multicap Fund with Other Multicap Funds

To help you make an informed decision, here’s how the Motilal Oswal Multicap Fund compares with other leading multicap funds in terms of performance:

| Fund Name | 1-Year Return | 3-Year Return | 5-Year Return | Expense Ratio |

|---|---|---|---|---|

| Motilal Oswal Multicap | 18.5% | 22.3% | 15.8% | 1.79% |

| Axis Multicap Fund | 17.0% | 21.5% | 14.5% | 1.72% |

| Nippon India Multicap | 16.2% | 20.4% | 13.3% | 1.82% |

Motilal Oswal Multicap Fund SIP Returns: A Case Study

To better understand the potential returns, let’s look at a SIP investment in the Motilal Oswal Multicap 35 Fund. If you were to invest ₹5,000 per month for 5 years, here’s an estimate of your returns (assuming an annual return of 15%):

| Investment Amount | Total Investment | Estimated Returns | Value After 5 Years |

|---|---|---|---|

| ₹5,000/month | ₹3,00,000 | ₹3,50,000 | ₹6,50,000 |

FAQs About Motilal Oswal Multicap Fund

1. What is the minimum investment in Motilal Oswal Multicap Fund?

The minimum investment in the Motilal Oswal Multicap Fund for the regular growth option is ₹1,000, and for the direct growth plan, it’s ₹500.

2. Can I invest in the Motilal Oswal Multicap Fund via SIP?

Yes, you can invest in the Motilal Oswal Multicap Fund through a SIP with as low as ₹500 per month.

3. Is Motilal Oswal Multicap Fund a good investment?

The Motilal Oswal Multicap Fund has provided consistent returns over the years and is a good option for investors looking for long-term capital growth through a diversified equity portfolio.

4. What is the NAV of the Motilal Oswal Multicap Fund?

The NAV of the Motilal Oswal Multicap Fund changes daily based on the market performance. You can track the latest NAV on the official website or through your mutual

Conclusion: Should You Invest in Motilal Oswal Multicap Fund in 2025?

If you are looking for long-term growth, a diversified portfolio, and a fund that adapts to market conditions, the Motilal Oswal Multicap Fund could be a strong addition to your investment strategy in 2025. The combination of stability and growth makes it an ideal option for both beginners and experienced investors. However, as with any equity fund, be sure to assess your risk tolerance and investment horizon before making a decision.

Also Read

Thematic SIPs for 2025: Why AI & Green Energy SIPs Will Skyrocket Your Wealth

Achieve Rs 1.81 Lakh Monthly Income with a Rs 16,000 SIP: Best Ultimate Retirement Planning Guide