Orient Green Power Share Price Target 2030: Detailed Forecast and Analysis

Explore the Orient Green Power share price target 2030 with detailed analysis and predictions for 2025, 2026, and beyond. Learn about the company’s growth, market potential, and renewable energy investments.

Table of Contents

As renewable energy continues to shape the future, Orient Green Power Ltd stands out as a leading player in India’s wind and biomass energy sector. Investors are increasingly eyeing this stock for its growth potential.

In this blog, we provide a comprehensive forecast for Orient Green Power share price target 2030, including detailed predictions for 2025, 2026, and the years leading up to 2030. Let’s dive into the key factors driving this growth and what you can expect from the stock in the coming years. Orient Green Power share price target 2025.

Orient Green Power Limited has been a topic of interest among investors recently, with many searching for insights on its share price history, latest news, and future price targets. This blog covers everything from Orient Green Power share price targets for 2022, 2024, and 2025 to a detailed prediction for 2030.

Key Developments Impacting Orient Green Power Share Price Target 2030

Several recent developments are adding fuel to Orient Green Power’s growth trajectory:

- Rights Issue Expansion: The company recently increased its rights issue size from ₹225 crores to ₹300 crores, enhancing its financial flexibility.

- Debt Clearance: Orient Green Power successfully cleared its outstanding loan with Yes Bank, strengthening its balance sheet and investor confidence.

- Strong Stock Performance: Recently, the stock surged by 4.83%, closing at ₹21.70, reflecting investor optimism about the company’s prospects.

Orient Green Power Share Price Target 2025: Predictions for the Short-Term Growth

Looking at 2025, the share price target for Orient Green Power shows a steady upward trend, supported by a growing focus on renewable energy and the company’s expansion efforts in wind and biomass energy production.

| Month (2025) | Maximum Target (₹) | Minimum Target (₹) |

|---|---|---|

| January | ₹44.10 | ₹30.72 |

| February | ₹46.66 | ₹32.55 |

| March | ₹47.92 | ₹33.20 |

| April | ₹48.01 | ₹33.02 |

| May | ₹48.94 | ₹34.99 |

| June | ₹49.21 | ₹36.00 |

| July | ₹52.51 | ₹36.05 |

| August | ₹52.92 | ₹37.73 |

| September | ₹53.41 | ₹39.76 |

| October | ₹54.02 | ₹40.44 |

| November | ₹55.29 | ₹40.90 |

| December | ₹56.01 | ₹41.30 |

These targets are based on expected developments such as government incentives for the renewable energy sector and continued demand for wind and biomass energy. The stock is expected to see moderate growth, with significant upward momentum towards the end of the year.

Also Read – Heritage Foods Share Price Target 2024 to 2030

Orient Green Power Share Price Target 2026: Optimistic Projections for Clean Energy Growth

As we move toward 2026, Orient Green Power is expected to show more robust growth due to the increased global focus on clean energy. The company’s continued investment in renewable energy infrastructure and debt reduction strategies will likely position it as a top contender in the renewable sector.

| Month (2026) | Maximum Target (₹) | Minimum Target (₹) |

|---|---|---|

| January | ₹69.20 | ₹43.91 |

| February | ₹72.50 | ₹45.65 |

| March | ₹74.75 | ₹47.20 |

| April | ₹76.33 | ₹48.99 |

| May | ₹78.22 | ₹50.00 |

| June | ₹80.50 | ₹52.31 |

| July | ₹83.12 | ₹53.85 |

| August | ₹84.45 | ₹55.62 |

| September | ₹86.25 | ₹57.00 |

| October | ₹88.20 | ₹58.20 |

| November | ₹90.50 | ₹59.80 |

| December | ₹92.00 | ₹61.25 |

As the renewable energy sector grows, Orient Green Power stands to benefit significantly. With government initiatives and technological advancements in energy production, this stock is expected to continue its upward trajectory through 2026.

Orient Green Power Share Price Target 2027-2030: Long-Term Projections for Growth

Looking ahead to the longer term, the Orient Green Power share price target for 2027 to 2030 continues to show impressive growth potential. The company’s long-term strategy, which includes expansion into emerging renewable energy markets and further operational efficiency, will help maintain positive stock performance.

| Year | Maximum Target (₹) | Minimum Target (₹) |

|---|---|---|

| 2027 | ₹77.84 | ₹50.22 |

| 2028 | ₹88.07 | ₹60.78 |

| 2029 | ₹98.02 | ₹75.43 |

| 2030 | ₹113.61 | ₹89.80 |

In the coming years, Orient Green Power is expected to benefit from the global shift towards sustainability and India’s green energy initiatives. As a leader in the wind and biomass energy market, the company’s strategic positioning will likely see its stock price reaching new highs in the long term.

Key Factors Driving Orient Green Power Share Price Target 2030 Growth

Several factors will influence Orient Green Power’s share price as it moves toward its 2030 target:

- Government Incentives: Government policies, subsidies, and incentives will continue to play a significant role in driving growth in the renewable energy sector.

- Technological Advancements: Innovations in wind and biomass energy technologies will allow the company to expand its capacity and reduce operational costs, enhancing profitability.

- Debt Reduction: The company’s progress in reducing debt is crucial for enhancing investor confidence and lowering risk.

Risks and Challenges Impacting Orient Green Power Share Price Target 2030

While the outlook for Orient Green Power is generally positive, investors should be aware of the risks:

- Regulatory Challenges: Changes in government policies or subsidies could impact revenue.

- Competition: The renewable energy sector is becoming increasingly competitive, with other companies vying for market share.

- Operational Risks: Natural disasters, supply chain disruptions, and technological failures could pose risks to operations.

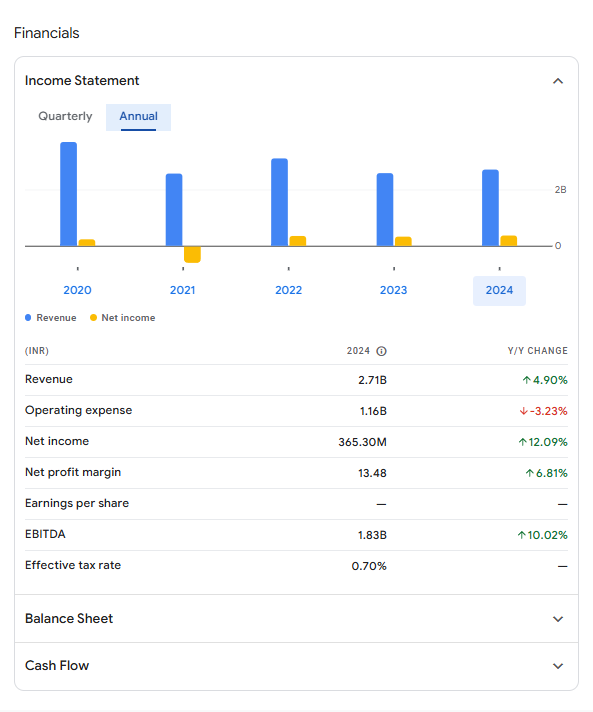

1. Historical Performance

Orient Green Power Share Price History and Chart Insights

Investors looking into the stock often start by analyzing its past performance. Orient Green Power share price history reveals significant fluctuations driven by market conditions and company performance. A closer look at the Orient Green Power share price chart provides deeper insights into trends and potential future movements.

2. Recent Updates

Orient Green Power Latest News and Market Trends

Staying updated with the Orient Green Power latest news is crucial for making informed decisions. Recently, headlines have focused on its expansion into renewable energy and investor interest in its sustainability-focused initiatives. For those asking, “Is Orient Green Power a good stock to buy?”, keeping track of market sentiment is key.

3. Year-Wise Share Price Predictions

Orient Green Power Share Price Targets for 2022, 2024, and 2025

Analysts have provided price targets for different years to help investors plan:

- Orient Green Power share price target 2024: ₹24–₹25

- Orient Green Power share price target 2025: ₹28–₹35

These targets reflect both past trends and future market projections, making it easier for investors to strategize.

4. Competitor Mention

Orient Green Power vs. Zee Entertainment Share Price Target 2025

Investors interested in renewable energy stocks like Orient Green Power might also be comparing it to other sectors, such as media. For instance, the Zee Entertainment share price target 2025 has garnered attention, offering a different risk-reward profile.

Conclusion: Is Orient Green Power a Good Investment for the 2030 Horizon?

With its strong market position, favorable growth factors, and ongoing improvements in debt management and infrastructure, Orient Green Power represents a promising investment in the renewable energy sector. The share price targets for 2025, 2026, and 2030 indicate significant potential for growth, making it an attractive choice for long-term investors looking to capitalize on India’s green energy transition.

FAQs – Orient Green Power Share Price Target 2030

1. What is the Orient Green Power share price target for 2030?

The Orient Green Power share price target for 2030 is projected to reach a maximum of ₹113.61 and a minimum of ₹89.80. This growth is attributed to the company’s strong positioning in India’s renewable energy sector and its ongoing expansion in wind and biomass energy.

2. Will Orient Green Power stock grow significantly by 2025?

Yes, Orient Green Power’s stock is expected to see steady growth by 2025, with a projected range of ₹30.72 to ₹56.01. The stock is supported by favorable government incentives, a growing demand for renewable energy, and ongoing efforts to expand its wind and biomass energy capacity.

3. How does the renewable energy market impact Orient Green Power’s stock?

The renewable energy market has a significant impact on Orient Green Power’s stock. As a key player in India’s wind and biomass energy sectors, the company benefits from increasing demand for clean energy, government incentives, and advancements in energy technologies, all of which contribute to positive stock performance.

4. What is the Orient Green Power stock price prediction for 2026?

For 2026, Orient Green Power’s stock price is expected to reach a maximum of ₹92.00 and a minimum of ₹61.25. The stock’s upward momentum is driven by increased global focus on clean energy and the company’s continued investment in renewable energy infrastructure.

5. What are the risks associated with investing in Orient Green Power?

Some potential risks to consider when investing in Orient Green Power include regulatory changes, intense competition in the renewable energy sector, and operational risks like natural disasters or technological failures. These factors could impact the company’s growth and stock performance.

6. How can government incentives affect Orient Green Power’s growth?

Government incentives play a crucial role in Orient Green Power’s growth. Policies, subsidies, and incentives for renewable energy companies help reduce operational costs and enhance profitability, making it a more attractive investment as the global shift towards clean energy continues.

7. Is Orient Green Power a good long-term investment?

Yes, Orient Green Power appears to be a strong long-term investment. With its strategic positioning in India’s renewable energy sector, plans for expanding energy capacity, and improving debt management, the company is well-positioned for sustainable growth, making it a good option for investors with a long-term horizon.

8. How will Orient Green Power’s debt reduction affect its stock?

Orient Green Power’s debt reduction is expected to positively affect its stock. By reducing outstanding loans and improving its financial flexibility, the company can lower risks, enhance investor confidence, and increase profitability, ultimately boosting its stock price.

9. Is Green Power a Good Stock to Buy?

Many investors wonder, “Is Green Power a good stock to buy?”. The answer depends on your risk appetite and belief in renewable energy’s growth potential. While the company has shown promise, thorough research is advised.

10. What is the Orient Green Power Share Target for 2021 and 2025?

The Orient Green Power share price target for 2021 was met with steady growth, driven by renewable energy demand. Looking ahead, the 2025 target suggests further upside if the company maintains its current trajectory.

Also Read : orient green power share price target 2025