Sarla Performance Fibers Share Price Target is a hot topic among investors eyeing the specialty textile sector in India. With a strong foothold in manufacturing high-performance fibers, Sarla Performance Fibers has garnered attention for its innovative approach, sustainable practices, and robust financials. This blog delves into the company’s stock performance, key growth factors, financial metrics, and predictions for share prices from 2024 to 2030.

Table of Contents

About Sarla Performance Fibers: A Leader in Specialty Fibers

Sarla Performance Fibers Ltd. is a prominent player in India’s specialty textile industry, providing high-quality fibers for sectors like automotive, apparel, and technical applications. Known for its sustainable practices and cutting-edge technologies, the company has established itself as a trusted name in both domestic and international markets.

Key Highlights:

- Strong Market Presence: Sarla Performance Fibers serves industries demanding premium fibers, with its products used in garments, car interiors, and high-strength technical fabrics.

- Innovation-Driven Growth: Sarla has invested significantly in R&D to develop eco-friendly and high-performance fibers.

- Sustainability: Its focus on green manufacturing resonates with global trends toward environmental responsibility.

Financial Overview: Sarla Performance Share Price Trends

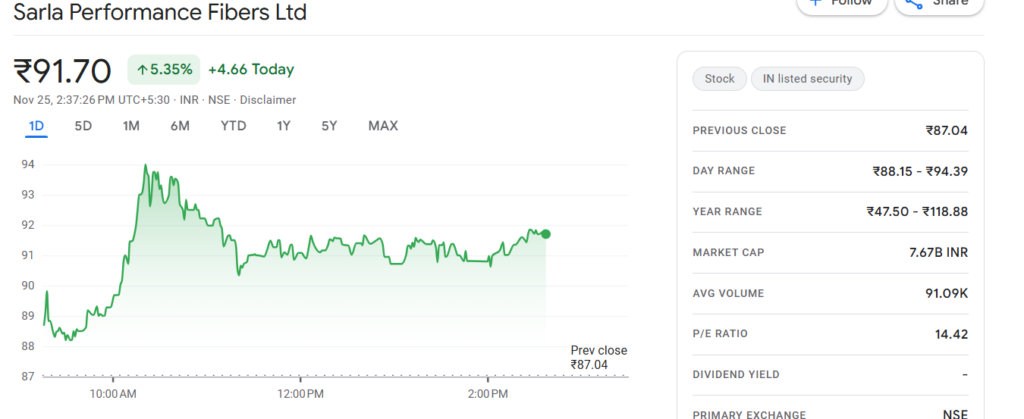

The financial strength of Sarla Performance Fibers underpins its share price performance. Here are some key metrics from recent market data:

- Current Market Price: ₹88.97

- 52-Week High/Low: ₹118.88 / ₹47.50

- Market Capitalization: ₹732.08 crore

- P/E Ratio: 13.71

- One-Year Growth: +72.19% (₹36.60 increase)

These figures highlight the strong investor confidence in Sarla Performance Fibers’ growth story, making it a favorite in the Indian specialty fiber market.

Sarla Performance Fibers Share Price Target from 2024 to 2030

Predicting the share price target of Sarla Performance Fibers involves analyzing market trends, financial performance, and macroeconomic factors. Below are the projected price targets:

| Year | Share Price Target |

|---|---|

| 2024 | ₹120 |

| 2025 | ₹156 |

| 2026 | ₹195 |

| 2027 | ₹237 |

| 2028 | ₹281 |

| 2029 | ₹322 |

| 2030 | ₹365 |

Factors Influencing Sarla Performance Share Price Growth

- Global Expansion: Sarla’s growing presence in international markets will likely boost its revenues. With demand for specialty fibers surging globally, the company is well-placed for growth.

- Government Policies: Initiatives like the Production-Linked Incentive (PLI) scheme for textiles provide a favorable environment for manufacturers like Sarla.

- Sustainability Trends: Sarla’s eco-friendly manufacturing aligns with global preferences for sustainable products, making its offerings attractive to a broader customer base.

- Rising Demand for High-Performance Fibers: The automotive and technical textiles sectors are witnessing increased demand for premium fibers, benefiting companies like Sarla.

Also Read–

Top 5 Infrastructure Mutual Funds India

Risks and Challenges

Despite its potential, Sarla Performance Fibers faces several challenges:

- Market Volatility: The textile industry is sensitive to raw material price fluctuations and geopolitical uncertainties.

- Competition: Intense competition from domestic and global players requires Sarla to continually innovate.

- Currency Risks: With overseas operations expanding, foreign exchange fluctuations could impact profitability.

Shareholding Pattern

The shareholding structure of Sarla Performance Fibers reflects a stable management and growing institutional interest:

- Promoter Holding: 56.67%

- Retail and Other Investors: 41.76%

- Domestic Institutions: 1.56%

- Foreign Institutions: 0.73%

Promoters’ significant stake underscores their commitment to the company’s long-term success.

What to Watch for in 2025 and Beyond:

Looking ahead, there are several factors that could significantly impact Sarla Performance Fibers Share Price. For instance:

- Expansion into New Markets: Sarla’s ongoing efforts to expand its presence in international markets, particularly in regions like the Middle East and Europe, could provide a solid revenue boost in the coming years.

- Innovation and Sustainability: As more industries push for sustainability, Sarla’s commitment to producing eco-friendly fibers can position the company as a leader in the industry. Sustainable practices in production are not only cost-effective but could appeal to environmentally conscious consumers and investors.

- Economic Factors: The overall market conditions, including domestic and international economic stability, inflation rates, and regulatory changes, can influence the company’s performance. For example, fluctuations in the cost of raw materials or changes in export duties can impact profit margins.

- Stock Performance and Technical Indicators: Investors should keep an eye on the technical analysis of Sarla Performance Fibers Share. Chart patterns, moving averages, and relative strength index (RSI) can provide insights into potential price movements, helping investors make informed decisions.

Factors to Keep in Mind Before Investing:

Before considering an investment in Sarla Performance Fibers, it is crucial to evaluate several factors that could affect the company’s financial health. Investors should look into:

- Company Fundamentals: Analyzing key financial indicators such as revenue growth, profit margins, debt levels, and cash flow will provide a clearer picture of the company’s ability to sustain its growth trajectory.

- Market Sentiment: Understanding how analysts and investors view the company can offer insight into its long-term performance. Positive sentiment can often result in upward price momentum, while negative sentiment may present an opportunity to buy at a lower price.

- Diversification: Given the inherent risks involved in investing in the stock market, it is essential to consider Sarla Performance Fibers as part of a diversified investment portfolio. Relying solely on one stock can be risky, especially in a sector prone to volatility like textiles.

What Experts Say About Sarla’s Future Stock Price:

Experts suggest that Sarla Performance Fibers Ltd Share Price could experience modest growth in the near term, with a more substantial rise anticipated if the company can maintain its current growth trajectory and capitalize on global expansion. According to industry analysts, Sarla’s shift towards sustainable practices and its robust product portfolio are critical factors that could help drive the stock price higher.

Investor Takeaways:

For potential investors, the key takeaway is that Sarla Performance Fibers Ltd offers a relatively stable investment in the textile sector with growth potential. While there are inherent risks, such as market volatility and commodity price fluctuations, the company’s forward-looking strategies provide ample opportunity for capital appreciation over time.

Additionally, it is advisable for investors to keep monitoring the company’s quarterly earnings reports, market trends, and news regarding government policies that could affect the textile industry. By doing so, investors can make well-informed decisions that align with their investment goals and risk tolerance.

Sarla Performance Fibers FAQs

1. What is the Sarla Performance Fibers share price today?

As of today, the Sarla Performance Fibers share price is INR 91.83.

Share prices can fluctuate throughout the trading day. For the most accurate and up-to-date price, check financial platforms such as NSE or BSE.

2. What is the Sarla Performance Fibers share price for 2024?

The Sarla Performance Fibers share price projected for 2024 is estimated to reach INR 120. This prediction is based on the company’s growth potential, including its international expansion and sustainable manufacturing practices, which are expected to drive the stock upwards.

3. Why is Sarla Performance Fibers share price rising?

Sarla Performance Fibers share price is rising due to several key factors:Strong financial performance: The company has seen significant revenue growth.

International expansion: Sarla is making strides into global markets, which is boosting investor confidence.

Innovative products: Sarla’s focus on high-tech fibers for textiles and automotive sectors is increasing its market share.

4. What is the Sarla Performance Fibers dividend yield?

Currently, Sarla Performance Fibers Ltd. does not offer a dividend yield. The company reinvests its profits into growth opportunities, particularly focusing on expansion in international markets and advancing its product line.

5. What is the Sarla Company Performance Fibers share price target for 2025?

For 2025, Sarla Performance Fibers share price is projected to reach INR 156. Analysts believe that continued market expansion and the company’s sustainable practices will drive long-term growth.

6. How do I buy Sarla Performance Fibers shares?

To buy Sarla Performance Fibers shares, you can open a demat and trading account with any SEBI-registered stockbroker. Once your account is set up, you can place a buy order for Sarla shares through your trading platform.

7. Is Sarla Performance Fibers a good investment?

Sarla Performance Fibers could be a good investment for those looking for growth in the textile and fibers sector, particularly due to its strong financials, expanding global presence, and sustainable business practices. However, it’s always recommended to consult a financial advisor to determine if it fits your portfolio.

8. What is the Sarla company’s future growth potential?

The Sarla company is focusing on international expansion and green manufacturing, which positions it well for future growth. As the demand for specialized fibers in textiles, automotive, and technical applications rises globally, Sarla is poised to capture a significant share of the market.

9. What is the Sarla Performance Fibers shareholding pattern?

The current shareholding pattern of Sarla Performance Fibers is:Promoter Holding: 56.67%

Retail and Other Investors: 41.76%

Foreign Institutional Investors (FII): 0.73%

Domestic Institutions: 0.83% This shows strong control by promoters and interest from domestic investors.

10. How has Sarla Performance Fibers share performed over the last year?

Over the past year, the Sarla share price has experienced an impressive increase of approximately 72.19%, rising by INR 36.60, reflecting strong market confidence and performance growth.

11. What is the Sarla Performance Fibers future price prediction?

Analysts predict that the Sarla Performance Fibers share will continue to show upward momentum, with a target price of INR 365 by 2030, driven by robust product offerings and international market penetration.

12. What is the difference between Sarla Performance Fibers Ltd and Sarla Fabrics?

Sarla Performance Fibers Ltd. specializes in manufacturing high-performance fibers for industries such as automotive, textiles, and technical applications. Sarla Fabrics, on the other hand, focuses on textile fabrics and apparel. Both companies are part of the broader Sarla company group but operate in different segments.

13. What is the Sarla Poly share price target?

SarlaPoly share price target for the next few years is projected to grow in alignment with Sarla Performance Fibers due to their interconnected operations. You can expect positive growth based on the company’s ongoing strategies and market trends.

14. How has the market capitalization of Sarla Performance Fibers changed?

The current market capitalization of Sarla Performance Fibers Ltd is INR 732.08 crore, and its value has been increasing steadily due to strong financials and rising investor confidence.

Conclusion: Is Sarla Performance Fibers a Good Long-Term Bet?

Sarla Performance Fibers is positioned for robust growth, thanks to its strong financials, innovative product lineup, and alignment with global trends. With sustainable practices and a focus on high-demand sectors, the company is well-equipped to capitalize on future opportunities. While challenges exist, strategic management and favorable macroeconomic conditions provide a solid foundation for long-term growth.

For investors seeking exposure to the specialty textile industry, The stock price is projected to grow. predictions make a compelling case for inclusion in portfolios.

Also Read-

Bajaj Housing Finance Share Price Target from 2024 to 2030: A Detailed Projection

IEX Share Price Target 2030: Updated Projections & Key Insights

Orient Green Power Share Price Target 2030: Detailed Forecast and Analysis