South Indian Bank Share Price Target 2030: From 2024 to 2030 – Expert Analysis

Explore the South Indian Bank share price target 2030 and projections from 2024 to 2030. Get expert insights and see price targets like ₹37 in 2024 and ₹140 by 2030.

Table of Contents

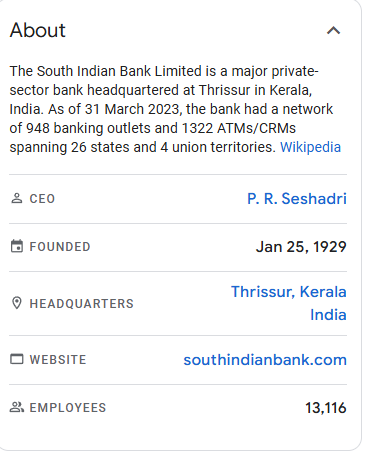

South Indian Bank Share Price Target 2030: A Comprehensive Review

South Indian Bank (SIB), one of India’s oldest private sector banks, is in the spotlight for its growth potential. This blog explores South Indian Bank share price target 2030, providing detailed projections and insights into the bank’s future performance based on its financial health, market dynamics, and key growth drivers.

If you’re an investor, this detailed review will help you evaluate South Indian Bank’s potential.

South Indian Bank Share Price Target 2030: Overview

Founded in 1929, South Indian Bank is a prominent player in the Indian banking sector. With a stronghold in Kerala and neighboring states, the bank provides retail banking, corporate banking, and treasury services.

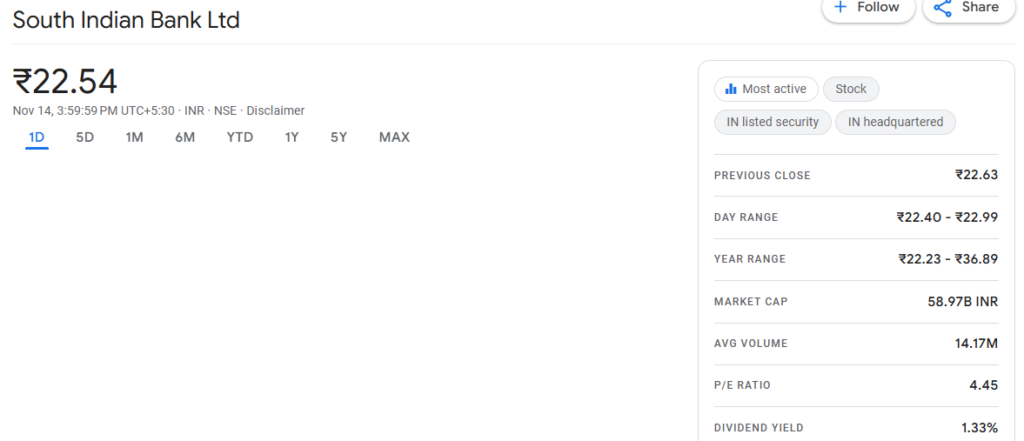

Key Financial Metrics (As of November 2024):

- Market Cap: ₹6,680 Crores

- Current Share Price: ₹24.15

- P/E Ratio: 5.06

- Dividend Yield: 1.18%

- 52-Week High: ₹36.89

- 52-Week Low: ₹21.18

With a solid foundation and innovative strategies, South Indian Bank is set to achieve its long-term goals.

South Indian Bank Share Price Target 2030: Recent Performance

The table below summarizes the recent performance of South Indian Bank’s stock:

| Date | Open (₹) | High (₹) | Low (₹) | Close (₹) |

| November 15, 2024 | 24.09 | 25.67 | 23.97 | 24.15 |

| November 14, 2024 | 23.85 | 24.75 | 23.55 | 24.00 |

| November 13, 2024 | 23.50 | 24.10 | 23.30 | 23.85 |

South Indian Bank Share Price Target 2024, 2025, and 2030: A Holistic View

The South Indian Bank share price target for 2024 and 2025 reflects steady growth, fueled by its focus on core banking and digital transformation. Analysts predict further momentum, projecting an optimistic South Indian Bank share price target 2030 due to its improving asset quality.

Market Dynamics and Growth Drivers for South Indian Bank Share Price Target 2030

1. Digital Transformation

South Indian Bank’s strategic investments in digital banking are driving operational efficiency and customer satisfaction.

2. Regional and National Expansion

The bank’s focus on expanding beyond southern India ensures diversification and growth.

3. Declining Non-Performing Assets (NPAs)

With significant reductions in NPAs, South Indian Bank is strengthening its financial stability.

4. Favorable Economic Environment

India’s economic growth and increased demand for financial services position South Indian Bank for long-term success.

South Indian Bank Share Price Target 2030: Projections for 2024-2030

Here’s the projected share price target for South Indian Bank:

| Year | Share Price Target (₹) |

| 2024 | 37 |

| 2025 | 50 |

| 2026 | 62 |

| 2027 | 78 |

| 2028 | 95 |

| 2029 | 120 |

| 2030 | 140 |

Key Factors for South Indian Bank Share Price Target 2030

Leadership in Banking

With decades of experience, South Indian Bank remains a trusted financial institution.

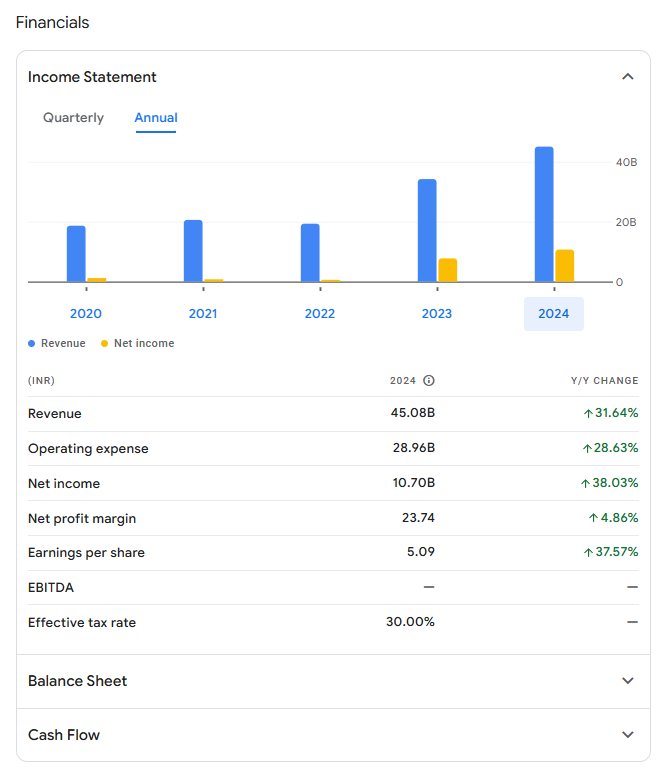

Strong Financial Performance

Consistent profitability and cost-cutting measures enhance its investment appeal.

Government and Regulatory Support

Favorable policies create a supportive environment for the bank’s growth.

Technological Innovations

Leveraging AI and other advanced technologies, South Indian Bank is improving efficiency and customer engagement.

Key Highlights:

- Southbank share price target aligns with growth in retail banking.

- Insights into South Indian Bank historical share price show a stable trend.

- With strategic expansions, South Indian finance is set to strengthen its market position.

Understanding Intrinsic Value and Dividend Potential

The intrinsic value of South Indian Bank is closely linked to its fundamentals, offering insights for long-term investors. Additionally, expectations for the South Indian Bank dividend 2024 highlight the bank’s commitment to shareholder returns.

South Indian Bank Share Price Target 2030: Shareholding Pattern

Shareholding Breakdown (As of November 2024):

- Retail & Others: 81.45%

- Foreign Institutions: 13.44%

- Other Domestic Institutions: 2.91%

- Mutual Funds: 2.19%

Why Invest in South Indian Bank Share Price Target 2030?

Advantages:

- Undervalued stock with promising growth potential

- Strategic expansion plans and digital initiatives

- Solid financial health and declining NPAs

Risks:

- Macroeconomic headwinds could impact growth

- Rising competition in the private banking sector

Understanding Intrinsic Value and Dividend Potential

The intrinsic value of South Indian Bank is closely linked to its fundamentals, offering insights for long-term investors. Additionally, expectations for the South Indian Bank dividend 2024 highlight the bank’s commitment to shareholder returns.

Conclusion: South Indian Bank Share Price Target 2030 – A Bright Investment Opportunity

South Indian Bank is on track to achieve its long-term goals, with a projected share price target of ₹140 by 2030. With its focus on digital transformation, strategic growth, and operational efficiency, the bank offers an attractive investment opportunity for long-term investors.

“Curious if South Indian Bank is open today? Check the latest market updates and plan your investment strategy effectively!”

FAQ

1. What is the expected South Indian Bank share price target for 2030?

The expected share price target for South Indian Bank in 2030 depends on various factors such as the bank’s growth, market conditions, and economic performance. Analysts have different projections, which can be influenced by its performance in the coming years.

2. What factors will impact South Indian Bank’s share price by 2030?

Factors such as the bank’s financial performance, expansion plans, loan growth, asset quality, economic environment, and interest rates will play a significant role in determining its share price target in 2030.

3. Should I invest in South Indian Bank for the long term (2030)?

Long-term investments in South Indian Bank depend on your risk tolerance, financial goals, and market conditions. It’s essential to analyze the bank’s financial health, future growth prospects, and overall market trends before making any investment decisions.

4. How does South Indian Bank’s performance compare to other banks in the sector?

South Indian Bank competes with other regional and national banks. It’s important to compare its performance with peers in terms of revenue growth, asset quality, and profitability to evaluate its potential for future growth and share price appreciation.

5. What are the key risks to consider before investing in South Indian Bank?

Key risks include market volatility, regulatory changes, asset quality concerns, interest rate fluctuations, and competition from other banks. Investors should consider these risks when planning for long-term investments.

6. Can I expect consistent growth in South Indian Bank shares till 2030?

While growth is possible, the bank’s performance may face fluctuations due to changing market conditions, global economic factors, and competition in the banking sector. It’s crucial to assess the bank’s strategy and market conditions regularly.

7. How can I track South Indian Bank’s progress toward its 2030 share price target?

Regularly reviewing quarterly earnings reports, news related to the bank’s strategies, and overall market trends can help investors track the bank’s progress. You can also monitor analysts’ reviews and stock price predictions.

8. What is the current outlook for South Indian Bank’s share price?

As of the latest data, the outlook for South Indian Bank’s share price depends on its quarterly results, regulatory changes, and broader market conditions. Keep an eye on the bank’s performance indicators for the latest trends.

great