Tata Steel Share Price Target from 2024 to 2030: Complete Guide for Investors

Discover detailed insights on Tata Steel Share Price Target from 2024 to 2030. Explore price predictions, growth opportunities, and expert advice for smart investments.

In the ever-changing stock market, staying ahead of the trends is essential. As one of India’s leading steel manufacturers, Tata Steel’s share price target holds great importance for investors. This blog explores Tata Steel’s share price target from 2024 to 2030, offering a detailed prediction to help you make informed investment decisions

Investing in stocks like Tata Steel Limited requires in-depth research and strategic decision-making. In this blog, we provide a detailed forecast of the Tata Steel Share Price Target from 2024 to 2030, helping investors make informed decisions. By analyzing the company’s performance, market trends, and future potential, we aim to deliver actionable insights.

Table of Contents

What is Tata Steel Limited?

Tata Steel Limited, part of the prestigious Tata Group, is one of the largest steel manufacturers globally. With a presence in over 50 countries, Tata Steel stands as a prominent name in the Indian steel sector and the international market. Founded in 1907, the company has expanded its operations over the decades, offering products across sectors like automotive, construction, and consumer goods.

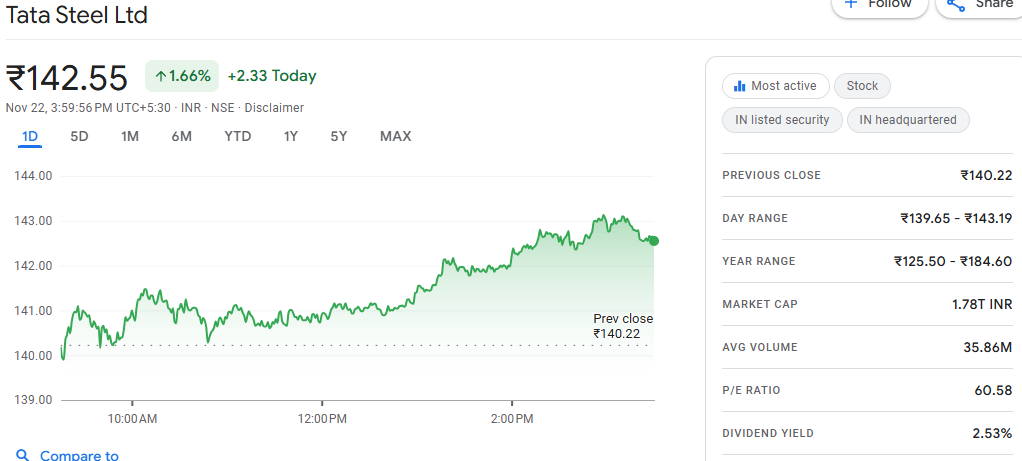

Tata Steel Share Price Overview

Before diving into the Tata Steel share price target for the next several years, let’s analyze its current market performance. Tata Steel has maintained a solid financial foundation, with consistent revenue and net income growth.

- Market Cap: ₹1.81 lakh crore

- Current Share Price (as of November 2024): ₹150.00

- Dividend Yield: 2.48%

- 52-Week High: ₹184.60

- 52-Week Low: ₹114.60

Tata Steel’s focus on innovation, sustainability, and global expansion makes it a promising stock for long-term investors.

Tata Steel Share Price Target: Year-by-Year Analysis

The Tata Steel share price target varies depending on market conditions, global steel demand, and other macroeconomic factors. Let’s look at the projected price targets for Tata Steel’s stock price from 2024 to 2030:

Price Targets by Year:

2030: ₹417 (1st target) | ₹371 (2nd target)rative stock for long-term investors.

2024: ₹187 (1st target) | ₹154.16 (2nd target)

2025: ₹211 (1st target) | ₹187 (2nd target)

2026: ₹242 (1st target) | ₹215 (2nd target)

2027: ₹276 (1st target) | ₹247 (2nd target)

2028: ₹318 (1st target) | ₹282 (2nd target)

2029: ₹364 (1st target) | ₹324 (2nd target)

Tata Steel Share Price Target Tomorrow Investors are often curious about the Tata Steel share price target tomorrow. Based on the recent market conditions, the target can fluctuate, but analysts predict a slight upward trend for tomorrow.

Tata Steel Share Price Target 2040 Long-term projections like the Tata Steel share price target 2040 indicate a steady rise in share price due to global demand for steel and Tata Steel’s continuous expansion into new markets.

TATA STEEL SHARE PRICE TARGET (2024 – 2030)

| YEAR | SHARE PRICE TARGET |

| 2024 | ₹189 |

| 2025 | ₹212 |

| 2026 | ₹242 |

| 2027 | ₹280 |

| 2028 | ₹320 |

| 2029 | ₹362 |

| 2030 | ₹419 |

Factors Affecting Tata Steel Share Price

Several factors influence the Tata Steel share price target, including the global demand for steel, production capacity, and raw material costs. Let’s break down the key components:

- Global Steel Demand: As one of the largest steel producers, Tata Steel’s share price is significantly impacted by the global demand for steel, especially in the automotive and construction sectors.

- Commodity Prices: Steel prices are closely tied to commodity price fluctuations, which can impact Tata Steel’s revenue.

- Regulatory Factors: Environmental regulations and government policies can affect the company’s operations and market standing.

- Technological Advancements: Innovations in steel production technologies may improve profitability and operational efficiency, affecting Tata Steel’s stock price.

Why Invest in Tata Steel?

Investing in Tata Steel shares offers several benefits, especially for long-term investors looking for stable returns. The company has a strong brand presence, a diversified product portfolio, and extensive global operations.

- Strength in Steel Industry: Tata Steel has a competitive advantage in the steel sector due to its large-scale operations.

- Consistent Growth: Over the years, the company has seen consistent revenue and profitability growth, ensuring solid returns for its shareholders.

How to Invest in Tata Steel Shares

To invest in Tata Steel shares, you can use popular trading platforms like Zerodha, Upstox, Groww, or Angel One. Follow these steps:

- Open a Demat account with your preferred broker.

- Search for Tata Steel Limited in the trading app.

- Place a buy order based on your investment strategy.

Peer Comparison: Tata Steel vs. Competitors

Tata Steel faces competition from other large steel manufacturers such as JSW Steel, SAIL, and Jindal Steel & Power. Here’s how Tata Steel compares with its peers in the steel industry:

- Jindal Steel Share History: Known for its strong domestic market, Jindal Steel also presents tough competition in global markets.ompetition, Tata Steel’s diversified portfolio and global presence give it a competitive edge.

- JSW Steel Share Price Target: A direct competitor to Tata Steel, JSW Steel’s share price target also shows upward movement, making it a formidable rival.

- SAIL Price Target: SAIL’s share price target is expected to follow similar trends as Tata Steel’s due to the growing demand in the steel industry.

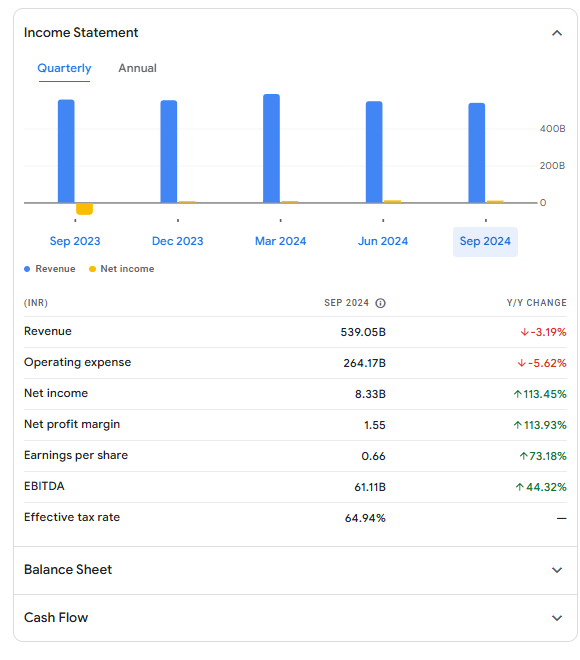

Quarterly Performance Analysis

| Quarter | Revenue (₹B) | Net Income (₹B) |

|---|---|---|

| June 2023 | 594.90 | 6.34 |

| Sept 2023 | 556.82 | -61.96 |

| Dec 2023 | 553.12 | 5.13 |

| March 2024 | 586.87 | 6.11 |

| June 2024 | 547.71 | 9.60 |

Advantages and Disadvantages of Investing in Tata Steel

Advantages

- Strong brand and market presence.

- Diversified product portfolio.

- Consistent revenue growth.

- Focus on sustainability and green technology.

Disadvantages

- Exposure to commodity price fluctuations.

- Regulatory and environmental risks.

FAQ: Tata Steel Share Price Target

1. What is the future growth potential of Tata Steel Limited?

Tata Steel is focusing on global expansion, sustainability, and product innovation, indicating significant growth potential by 2030.

2. Is Tata Steel a good stock for long-term investment?

Yes, Tata Steel’s strong financial performance, market presence, and commitment to sustainability make it a reliable long-term investment.

3. How does Tata Steel compare with its peers?

Tata Steel stands out due to its diversified portfolio, global operations, and leadership in sustainable practices, despite competition from companies like JSW Steel and SAIL.

4. Can Tata Steel achieve ₹417 by 2030?

Based on market trends, revenue projections, and the company’s strategic initiatives, the target of ₹417 by 2030 is achievable.

5. What is the Tata Steel Share Price Target for 2024?

The Tata Steel share price target for 2024 is ₹187, with a secondary target of ₹154.16.

6. What is Tata Steel’s historical price trend?

Tata Steel historical share price shows consistent growth over the years, making it a reliable stock for investors.

7. What is the Tata Steel BSL share price today?

The Tata Steel BSL share price today stands at ₹112.60, reflecting the company’s stable position in the market.

8. What factors affect the Tata Steel share price?

Key factors include global steel demand, commodity price fluctuations, and regulatory changes.

Conclusion

The Tata Steel share price target for the years 2024 to 2030 indicates a steady growth trajectory, driven by global steel demand, operational improvements, and strong financial health. Tata Steel’s solid reputation, coupled with its expanding product portfolio, makes it a promising investment in the long term.

Also Read-

Bajaj Housing Finance Share Price Target from 2024 to 2030: A Detailed Projection