Looking to invest in Unitech? Discover Unitech Share Price Target 2025, its growth potential, and how you can benefit from this opportunity.

Table of Contents

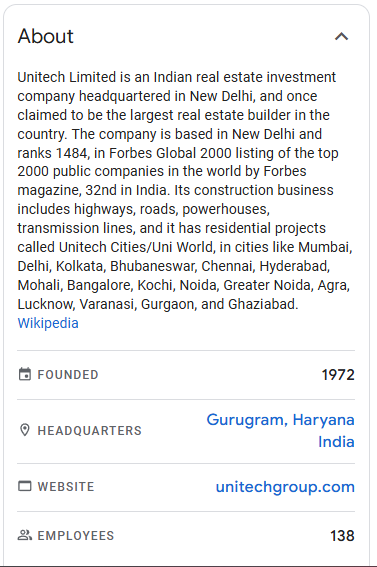

Unitech Share Price Target 2025 – An Overview

As of now, Unitech’s share price stands at ₹9.08, with a market capitalization of ₹2.38K crore. With its challenging history, including legal disputes and financial troubles, the real estate giant has seen ups and downs. But investors are closely watching its prospects in 2025 and beyond.

Current Market Price:

- ₹9.08

- Market Cap: ₹2.38K Cr

- 52 Week High: ₹18.50

- 52 Week Low: ₹1.90

Unitech Share Price Target 2025: Expert Insights

Unitech, one of India’s leading real estate developers, is poised for significant changes in the coming years. As of now, Unitech Share Price Target 2025 stands out as a compelling opportunity for investors. In this article, we’ll break down why experts are optimistic about Unitech’s share price potential in 2025 and beyond.

Key Factors Driving Unitech Share Price Target 2025

Several factors play a crucial role in determining the future of Unitech Share Price Target 2025, from market trends to internal growth initiatives. Let’s dive into these factors:

- Strong Real Estate Projects

Unitech has completed multiple residential and commercial developments, contributing to its growth trajectory. These projects, particularly in high-demand areas like Gurugram, are expected to bolster revenue, positively influencing the stock price. - Strategic Partnerships

Strategic partnerships with international investors and corporations could help Unitech improve its financial health, which might lead to a price surge. - Government Policies Supporting Real Estate

Recent government initiatives aimed at boosting the real estate sector in India are expected to benefit Unitech, raising its market value.

Unitech Share Price Target 2025: Yearly Forecast

Unitech Share Price Target 2024

Experts predict that Unitech will hit ₹18.90 by the end of 2024. This forecast is based on consistent revenue growth and positive market trends.

Unitech Share Price Target 2025

For 2025, the price is expected to climb to ₹28.04, reflecting recovery in the real estate market and new development projects.

Unitech Share Price Target 2026 to 2030

The next five years look promising for Unitech, with a price target of ₹31.54 in 2026, followed by ₹35.66 in 2027. By 2030, Unitech could potentially reach ₹57.45 based on market growth and financial stability.

| Year | Share Target Value (₹) |

|---|---|

| 2024 | 18.90 |

| 2025 | 28.04 |

| 2026 | 31.54 |

| 2027 | 35.66 |

| 2028 | 39.45 |

| 2029 | 46.21 |

| 2030 | 57.45 |

How Accurate is Unitech Share Price Target 2025?

While stock price targets are estimates, the prediction for Unitech Share Price Target 2025 is based on careful analysis of market trends, financial health, and real estate dynamics. Factors like economic recovery, government policies, and internal growth initiatives will likely impact the accuracy of this forecast.

Unitech Share Price Growth in 2025: What Factors Could Lead to a Surge?

Several factors could contribute to Unitech Share Price Target 2025 reaching higher values than anticipated:

- Improved Debt Management: Unitech’s ability to manage and reduce its debt could significantly boost investor confidence and stock price.

- Recovery of Real Estate Market: With the real estate sector expected to recover, Unitech stands to benefit greatly, especially in high-demand areas like NCR.

- Global Investments: Potential global partnerships and investments could increase the company’s growth prospects.

Unitech Shareholding Pattern

The current shareholding pattern is as follows, showcasing how much the market and major investors hold in Unitech:

| Shareholder Category | Percentage (%) |

|---|---|

| Retail and Others | 93.53% |

| Promoters | 5.13% |

| Other Domestic Institutions | 1.04% |

| Foreign Institutions | 0.30% |

| Mutual Funds | 0.01% |

This diverse mix of ownership could contribute to price stability and support price increases as retail investors and institutions push for growth.

Factors Affecting Unitech’s Share Price Target

1. Legal Challenges

Unitech has been embroiled in legal disputes that have affected its business operations. The resolution of these legal matters could lead to a significant recovery in the stock price.

2. Market Performance

Unitech operates in the highly competitive real estate industry. The Indian real estate market has been performing well in recent years, and if Unitech can take advantage of this boom, its share price could see significant upside.

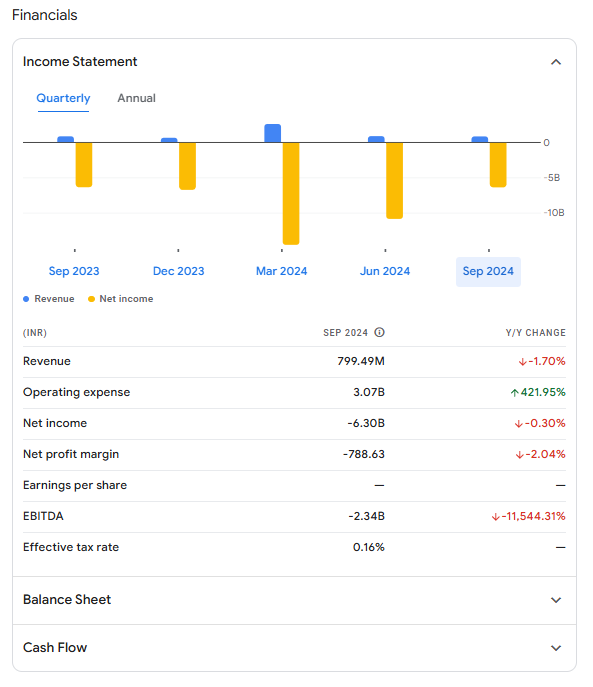

3. Financial Health

Financially, Unitech is undergoing a restructuring phase. As per the latest Annual Income Statement, there has been a significant increase in revenue, but a substantial loss in net income.

| Particulars | 2024 | Y/Y Change |

|---|---|---|

| Revenue | ₹4.77B | +17.69% |

| Operating Expenses | ₹2.23B | +37.44% |

| Net Income | -₹33.27B | -19.34% |

| EBITDA | -₹7.67B | -2658.89% |

As you can see, Unitech’s Net Income and EBITDA are in the negative, which needs to be addressed for long-term growth.

Unitech Share Price Target 2025: Investment Potential

Despite financial challenges, Unitech has the potential to turn things around by addressing its debt issues and leveraging the growth of the Indian real estate sector. Experts believe that the price target for Unitech shares in 2025 could rise significantly, especially if the company resolves its legal disputes and improves profitability.

Why Invest in Unitech?

Investors looking to diversify into real estate stocks can consider Unitech due to the following reasons:

- Growing real estate market: The demand for both residential and commercial properties in India is expected to rise.

- Debt restructuring: If Unitech successfully reduces its debt, its future growth prospects are strong.

- Long-term outlook: The company is poised to benefit from long-term urbanization trends in India.

FAQs: Unitech Share Price Target 2025

1. What is the expected price of Unitech stock by 2025?

The target price for Unitech Share Price 2025 is predicted to reach ₹28.04, based on strong growth in the real estate market and improving financials.

2. Should I buy Unitech shares now?

Considering Unitech’s strong growth forecast for 2025, it could be a good opportunity to invest, especially if the price dips below the target price.

3. Will the government’s policies affect Unitech share prices?

Yes, favorable policies supporting real estate development in India can contribute positively to Unitech Share Price Target 2025, leading to growth.

4. How does Unitech’s financial health impact its stock?

Unitech’s financial health, particularly its high debt burden and legal challenges, has impacted its stock price. However, successful restructuring could lead to a positive shift.

Conclusion: Unitech Share Price Target 2025 – A Good Investment Opportunity?

With Unitech Share Price Target 2025 showing significant potential for growth, investors looking for opportunities in the real estate sector should keep an eye on this stock. The projected growth in the real estate market, combined with strategic initiatives and favorable government policies, makes Unitech an exciting investment for 2025 and beyond.

Want to make smarter investment decisions? Stay updated with the latest news and insights on Unitech and other top stocks on – Mutualsip.com