Vedanta Share Price Target 2030: Expert Predictions & Analysis

Explore the Vedanta share price target 2030 with expert predictions. Learn about the future growth of Vedanta stocks and insights on its share price from 2024 to 2030.

Table of Contents

Vedanta Share Price Target 2030: Complete Analysis & Predictions

Investing in Vedanta shares offers a promising opportunity if you understand the company’s future potential. In this comprehensive guide, we’ll explore the Vedanta share price target 2030, focusing on expert predictions and key insights that can help you make informed decisions about your investment strategy.

Why Vedanta’s Share Price Target 2030 Is a Key Focus for Investors

With a diversified portfolio across mining, oil, gas, and metals, Vedanta has always been a strong contender in the Indian stock market. As we approach 2030, the Vedanta share price target 2030 has become an essential aspect of investment planning for long-term investors.

Analyzing the Growth Potential of Vedanta’s Stock for 2030

When projecting the Vedanta share price target 2030, it’s important to consider both the company’s past performance and future outlook. Let’s dive into some key factors influencing its price trajectory:

- Industry Diversification: Vedanta’s operations in oil, gas, zinc, and aluminum provide a strong foundation for continued growth.

- Global Demand for Resources: The global demand for resources such as zinc and copper, which Vedanta produces, is expected to rise, driving long-term growth.

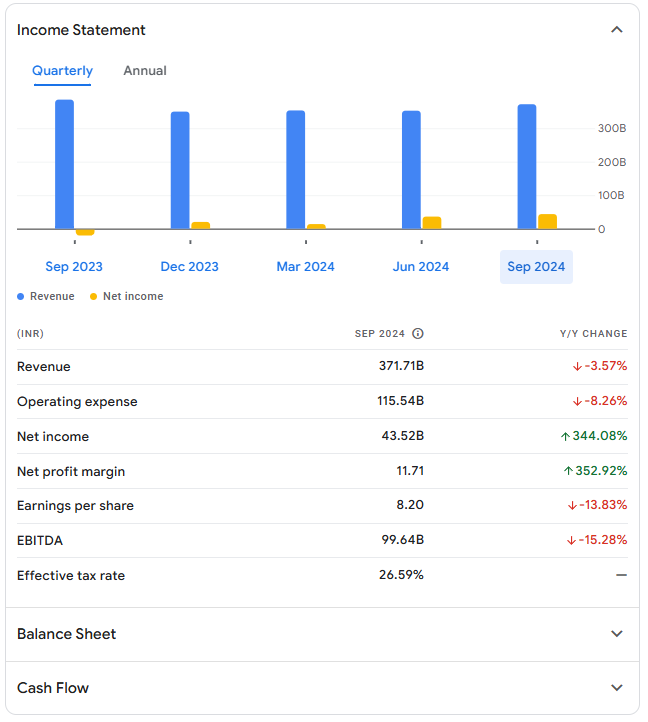

Overview of Vedanta’s Current Share Performance

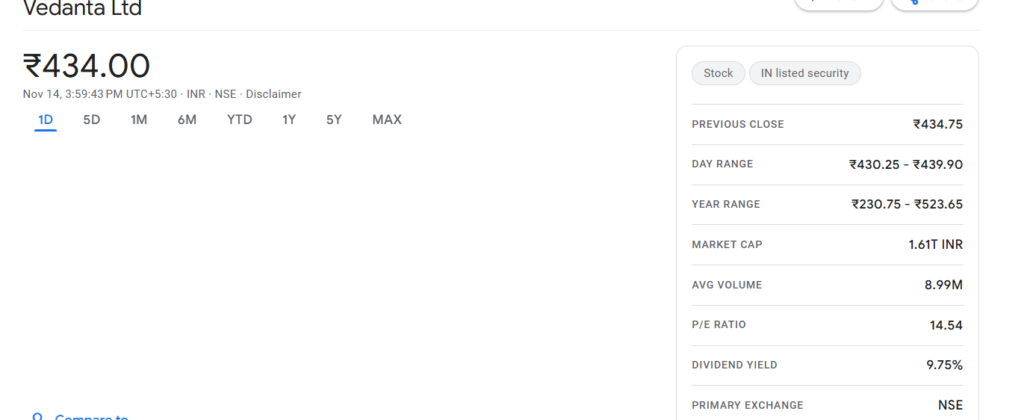

Market Cap: ₹1.68 lakh crore

P/E Ratio: 32.64

Dividend Yield: 9.36%

52-Week High: ₹523.65

52-Week Low: ₹230.75

These indicators make Vedanta shares a compelling option for long-term investors. The company’s consistent earnings growth, strong dividend yield, and vast industry presence contribute to its solid market position.

Vedanta Share Price Target 2024-2030: Expert Predictions

According to market experts, the Vedanta share price target 2030 is set for steady growth. Here’s a detailed forecast for the stock from 2024 to 2030:

| Year | Target Price (₹) |

| 2024 | ₹510.66 |

| 2025 | ₹590.25 |

| 2026 | ₹684.01 |

| 2027 | ₹766.30 |

| 2028 | ₹887.54 |

| 2029 | ₹925.70 |

| 2030 | ₹1,022.00 |

This steady upward trend reflects Vedanta’s strong market positioning, increased resource demand, and strategic expansion plans.

Vedanta Share Price Today and Key News

To better understand the Vedanta share price today, it’s essential to stay updated with market news. Recently, Vedanta has been expanding its production in high-demand sectors like aluminum and copper, which could lead to higher revenue and growth.

Keeping an eye on Vedanta today news and market sentiment will give you a clearer picture of its stock movement.

Why Investors Are Eyeing Vedanta Share Price Target 2030

The future growth of Vedanta is strongly tied to its expansion plans and market conditions. Let’s look at why the Vedanta share price target 2030 is worth monitoring:

- High Dividend Yield: With a solid dividend payout, Vedanta provides consistent returns to long-term investors.

- Market Dominance in Natural Resources: Vedanta’s dominance in sectors like oil, gas, and mining means it is well-positioned for continued profitability.

- Government Support: India’s growing infrastructure needs will also favor Vedanta’s business growth in the coming years.

Risks to Keep in Mind with Vedanta Share Price Target 2030

While the Vedanta share price target 2030 looks promising, it’s crucial to be aware of potential risks:

- Commodity Price Fluctuations: As a natural resource company, Vedanta’s performance is impacted by global commodity price fluctuations, which could affect stock price growth.

- Environmental and Regulatory Risks: Mining and resource extraction have regulatory hurdles that could slow down Vedanta’s expansion plans.

How to Invest in Vedanta Stocks

If you’re considering investing in Vedanta shares, make sure to track the Vedanta share price today regularly. The simplest way to invest in Vedanta stocks is through online platforms like Zerodha, Groww, and Upstox. Keep in mind the potential long-term growth indicated by the Vedanta share price target 2030 when making your investment decisions.

FAQs on Vedanta Share Price Target 2030

Q1: What will Vedanta’s share price be in 2030?

Based on expert predictions, the Vedanta share price target 2030 is expected to be ₹1,022, reflecting a consistent rise from its current levels.

Q2: How safe is investing in Vedanta stocks?

Investing in Vedanta stocks is considered relatively safe, especially for long-term investors, due to the company’s diversified operations and strong market presence. However, like any stock, it’s important to be aware of market risks.

Why Vedanta Share Price Target 2030 Matters for Long-Term Investors

The Vedanta share price target 2030 is important for long-term investors because it shows how the company is expected to grow over the next decade. With a focus on natural resources, Vedanta is poised for long-term success, making it a valuable addition to any portfolio.

Conclusion

In conclusion, the Vedanta share price target 2030 presents an exciting opportunity for long-term investors. With its strong market position, high dividend yield, and continued expansion, Vedanta stocks are likely to experience steady growth, making it a promising investment option.

Mutualsip.com Want to take advantage of Vedanta’s share price growth? Stay updated with the latest news and predictions on Vedanta share price target 2030 to make informed investment decisions. Buy Vedanta shares today and prepare for a prosperous future!